Understanding Vertiv Holdings Co: A Deep Dive into VERX Stock

Vertiv Holdings Co (NYSE: VERX), a global provider of critical digital infrastructure and continuity solutions, is a name that’s been making the rounds among savvy investors and stock market enthusiasts. In a world where data reigns supreme, Vertiv’s role in ensuring the smooth operation of data centers, communication networks, and commercial and industrial facilities has proven to be of paramount importance. This blog post aims to provide an exhaustive look at VERX stock, its market performance, future potential, and why it could be worth considering for your investment portfolio.

The Rise of Digital Infrastructure: A Fertile Ground for Vertiv

The surge in remote work, increased online services, and the proliferation of the Internet of Things (IoT) have led to an unprecedented demand for reliable digital infrastructures. Companies like Vertiv are at the heart of this transformation, offering products and services that are essential for data centers and telecommunications sites.

A. Vertiv’s Market Position

Vertiv’s standing in the market is strong, with a focus on innovation and customer service that sets it apart from competition. Despite market volatility, the company’s strategic vision aims to capitalize on long-term trends involving edge computing and the transition to 5G networks.

B. Financial Performance of VERX Stock

Vertiv’s financials are a key point of interest for investors. As with any public company, financial health is indicative of how well the company can maintain operations, invest in growth, and return value to shareholders. We’ll delve deeper into the financial metrics and earnings reports that shed light on Vertiv’s performance.

C. Analyst Opinions and Predictions

The opinions of financial analysts can provide valuable insights and outlooks, offering a wider perspective on how VERX is viewed within the financial community. These predictions can be a useful tool when assessing the stock’s future trajectory.

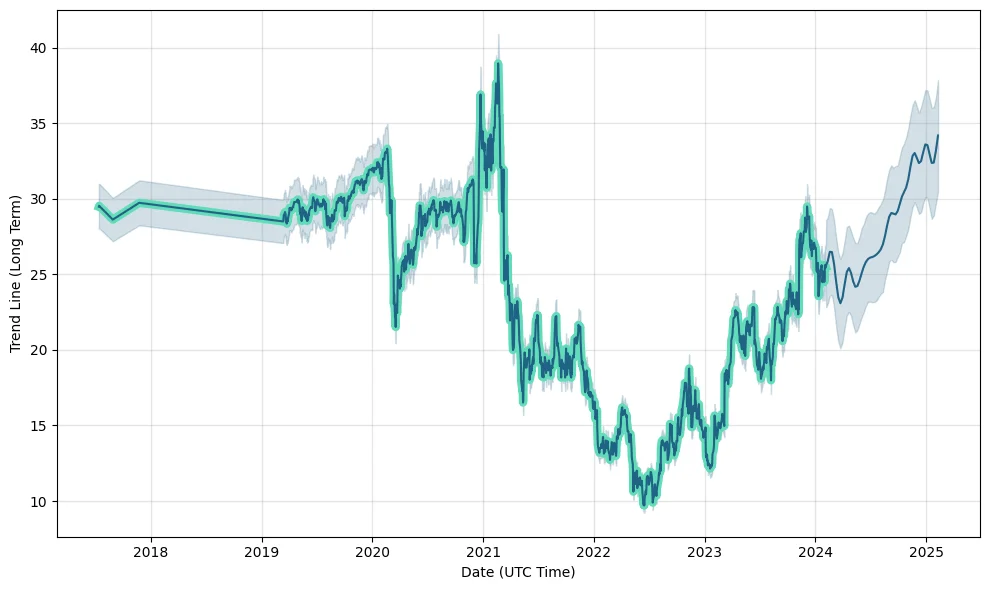

Navigating the Turbulence: VERX Stock’s Performance Amidst Market Fluctuations

Investing in the stock market is inherently risky, and even stable markets face their share of ups and downs. In this section, we look at how VERX has fared in recent times, especially during economic uncertainty brought about by global events such as the ongoing pandemic and geopolitical tensions.

A. Volatility and Risk Assessment

We discuss the volatility of VERX, examining historical price movements, and analyzing how the stock has responded to market-wide shifts. It is important for investors to understand the risk profile of VERX and how it could impact their investment.

B. Comparative Analysis with Competitors

By comparing Vertiv to its competitors, we can contextualize its performance and gauge where it stands in the industry. A side-by-side comparison can reveal strengths and weaknesses that may not be evident when looking at VERX alone.

C. Shareholder Value and Returns

We analyze the returns that VERX shareholders have realized over the years, including dividends, if any, and stock appreciation. Shareholder value is a crucial aspect when evaluating the attractiveness of a stock as a potential investment.

Forward-Looking Projections: What Does the Future Hold for VERX?

With an eye towards the future, we speculate on the potential for Vertiv Holdings Co in the coming years. In this rapidly evolving digital landscape, anticipating future trends and company initiatives is key to making informed investment decisions.

A. Expansion Plans and Market Opportunities

Understanding Vertiv’s expansion plans gives us a glimpse of the company’s confidence in its growth prospects. We explore upcoming opportunities and how the company plans to tap into new markets or deepen its reach in existing ones.

B. Potential Risks and Challenges

Investing is not without its dangers, and it’s imperative to consider the potential risks Vertiv faces. We assess economic, industry-specific, and company-level challenges that could affect VERX stock.

C. Investment Strategies for VERX

In conclusion, we lay out various strategies that investors might employ when adding VERX to their portfolios, whether for short-term gains or long-term growth. Each investor’s goals and risk tolerance will influence how they might integrate VERX into their investment approach.

(DISCLAIMER: This blog post is intended for informational purposes only and should not be taken as financial advice. Before making any investment decisions, consult with a financial advisor and conduct your own research.)

Vertiv Holdings Co represents an intriguing option for investors looking to tap into the growing need for resilient digital infrastructure. In this detailed examination of VERX stock, we have provided a comprehensive overview aiming to assist in your journey as an investor. Whether you’re a seasoned trader, a financial analyst, or simply an investment enthusiast, keeping an eye on the developments of VERX could be a wise addition to your investment considerations.

Remember, the stock market is an ever-changing ecosystem, and staying informed is your most powerful tool. Keep learning, keep analyzing, and most importantly, keep adapting to the fluid dynamics of the investing world.

Post Comment