Deciphering BITO: A Comprehensive Guide to Tracking Bitcoin ETF Prices

The introduction of the ProShares Bitcoin Strategy ETF (ticker: BITO) in October 2021 was a monumental event for cryptocurrency enthusiasts and traditional investors alike. For the first time, a financial product was available on the New York Stock Exchange that provided exposure to Bitcoin performance without the complexities of direct investment in the cryptocurrency.

In this deep dive, we’re making sense of the BITO stock price for a wide array of investors—from the curious newbie in the world of trading to the well-versed cryptocurrency enthusiast, and everyone in between. Join us as we explore the inner workings of this pioneering investment vehicle, understand what influences its pricing, and reveal how it can fit into an investment portfolio.

Understanding BITO and Its Relation to Bitcoin

What exactly is BITO?

BITO is an exchange-traded fund (ETF) that allows investors to gain exposure to Bitcoin’s price movements through futures contracts. It does not invest directly in Bitcoin but in contracts predicting the future price of Bitcoin on commodity exchanges. This setup is designed to reflect the performance of Bitcoin, accounting for the expenses of the fund.

Why is BITO significant?

BITO opens doors for investors who are either restricted from direct cryptocurrency investments or are looking to mitigate some risks associated with digital wallets, security, and other complexities of holding actual Bitcoin. It’s the bridging of a gap between two vastly different investing worlds.

The BITO Stock Price Mechanics

How is BITO’s price determined?

Unlike traditional stocks, BITO’s price isn’t directly linked to company performance but rather to the movements of Bitcoin futures. These contracts speculate on the future price of Bitcoin, and this speculation, driven by market sentiments, demand, and supply intricacies, leads to daily fluctuations in BITO’s price.

Key factors affecting BITO’s price

- Bitcoin Volatility: Given BITO’s close link to Bitcoin, volatility in Bitcoin markets will spill over into BITO.

- Futures Market Conditions: The contango or backwardation scenarios in futures markets can impact BITO’s performance.

- Investor Sentiment: The broader sentiment around cryptocurrency regulation, technological developments, and institutional adoption can influence BITO.

- Trading Volume: As trading volume increases, liquidity improves, potentially leading to more stable price action.

The Influence of Market Sentiments and Events

Market sentiments can sway BITO prices significantly. Positive news, such as a country legalizing Bitcoin, can lead to upward spikes, while regulatory crackdowns can cause dips. Furthermore, mainstream acceptance of cryptocurrencies by corporations or the launch of new crypto-related services by financial institutions can play a pivotal role in BITO’s price trends.

Tracking BITO: Tools and Techniques

Price Tracking Tools

Investors keep tabs on the BITO stock price through various platforms:

- Financial news websites like Bloomberg and CNBC

- Stock trading apps like Robinhood or E*TRADE

- Cryptocurrency-specific platforms providing ETF tracking

- Social media channels offering real-time updates like Twitter and Reddit

Fundamental Analysis

This involves looking at the intrinsic value of the ETF by examining related Bitcoin market trends, futures market conditions, and the overall economic environment.

Technical Analysis

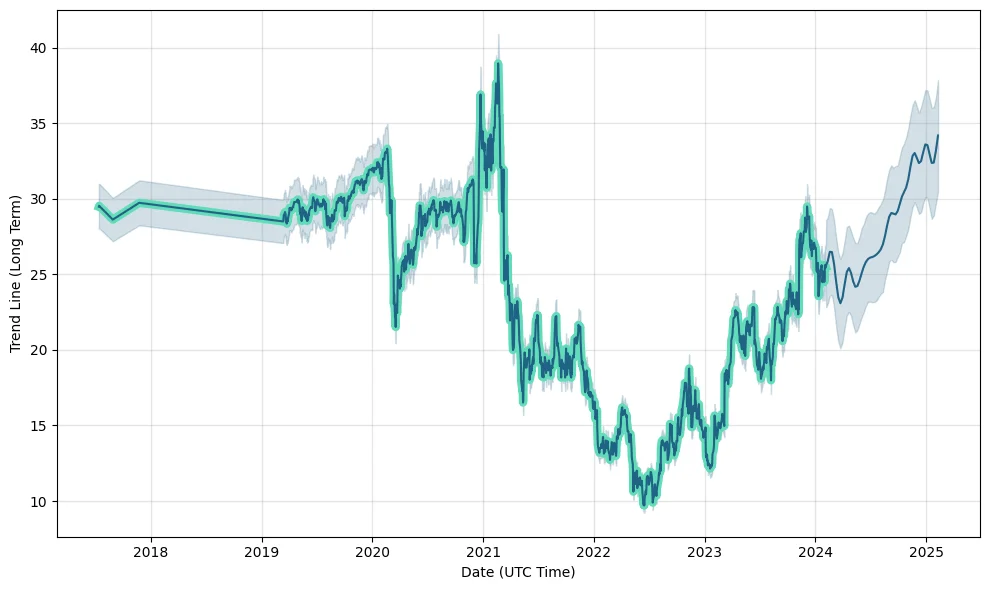

Many turn to charts and technical indicators to forecast future price movements based on past trends, employing analysis tools like moving averages, RSI (Relative Strength Index), or Bollinger Bands.

BITO as Part of a Diversified Portfolio

Investors might consider adding BITO to diversify risk. Since its behavior can differ from stocks, bonds, and other assets, it provides an opportunity to hedge against market uncertainty. However, the inherent volatility of cryptocurrency markets means that BITO may suit those with higher risk tolerance or those who have a comprehensive understanding of the crypto space.

Final Thoughts

The BITO stock price provides a fascinating glimpse into the intersection of traditional investment mechanisms with the cutting-edge realm of cryptocurrencies. Whether you’re a seasoned investor or simply crypto-curious, understanding these dynamics is crucial to informed investment decisions. As with any investment, due diligence, continuous learning, and an adherence to personal risk tolerance are paramount.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Before making any investment decisions, seek advice from a financial professional.

Whether BITO seamlessly aligns with your investment strategy or serves as a cautionary tale of market complexities, one thing is certain: the dialogue between traditional finance and the burgeoning world of cryptocurrency is just beginning, and BITO is one of its first lexicons. As you navigate the evolving landscape, keep your portfolio’s language adaptable, your risk management proactive, and your curiosity piqued. Happy investing!

Post Comment