Understanding NET Stock: A Primer for Market Newbies and Investors

Investing in the stock market can be an exciting venture, but it’s also fraught with complexities and jargon that can intimidate the uninitiated. One of the stocks that have garnered significant interest in recent times is NET stock—Cloudflare, Inc.’s ticker symbol on the New York Stock Exchange. Whether you’re a stock market newbie, an aspiring investor, or a seasoned financial analyst, understanding the dynamics of NET stock could be instrumental for your investment strategy.

Why Cloudflare (NET) Matters

Cloudflare is a global company that provides a content delivery network (CDN), security, and distributed domain name server services, among other functions. The need for such services has exploded with the growth of the internet and the increasing demand for cybersecurity. As of [latest report], Cloudflare has continued to expand its services and client base, which can frequently translate into increased investor interest and a potential rise in stock value.

The Appeal of NET Stock

For investors who are considering NET stock for their portfolio, the company’s cutting-edge technology and positioning within the industry are appealing. It is essential to understand what makes NET stock a potential investment:

- Innovation: Cloudflare is known for its innovative edge in the tech industry. The company’s regular rollouts of new products can impact its growth prospects and stock performance positively.

- Market Position: Cloudflare has carved out a niche in the cybersecurity space, making it essential infrastructure for internet operations.

- Financial Health: Evaluating Cloudflare’s earnings reports, revenue growth, and profit margins is crucial. Financial analysis can help ascertain the company’s health and potential as an investment.

How to Evaluate NET Stock for Your Portfolio

Before adding NET stock to your portfolio, you should conduct a thorough analysis:

- Analyze Fundamentals: Examine Cloudflare’s financial statements, including its balance sheet, income statement, and cash flow statement. Check the company’s Price/Earnings (P/E) ratio, earnings per share (EPS), and debt-to-equity ratio.

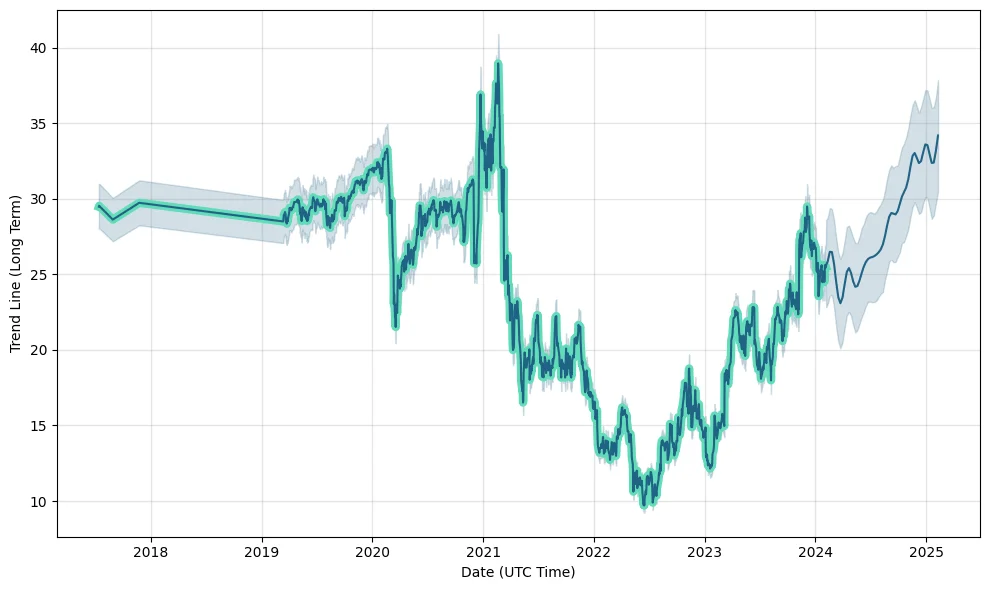

- Technical Analysis: Look at NET stock’s price movements and chart patterns to identify trends and make predictions about future movements.

- Assess Market Trends: Stay informed about the tech sector’s overall performance and understand how market changes could affect NET stock.

- Risk Management: Assess your risk tolerance and consider diversification to manage potential volatility associated with NET stock.

Potential Risks and Considerations

- Volatility: As with any tech stock, NET can be subject to high volatility due to market sentiment, technological shifts, and competitive pressures.

- Regulatory Environment: Changes in data privacy laws and regulations could impact Cloudflare’s operations and profitability.

- Economic Factors: Broader economic trends, including interest rate changes and economic downturns, can affect investors’ appetite for tech stocks.

Final Thoughts

Investing in NET stock can be an excellent opportunity, but it requires due diligence, financial literacy, and ongoing market analysis. Keep a close eye on Cloudflare’s company news, quarterly earnings reports, and industry trends. Commit to continuous learning, consult financial advisors when necessary, and approach the market with both confidence and caution.

Remember, while stocks like NET can offer tremendous growth potential, they carry risks that merit careful consideration. The stock market is not a one-size-fits-all environment; investments should align with your personal financial goals, investment strategy, and risk tolerance.

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Please consult a financial advisor before making any investment decisions.

Are you looking to dive deeper into the stock market? Be sure to subscribe and follow our blog for more insights, analysis, and up-to-date stock market tips to empower your investing journey.

Happy investing!

Post Comment